The date is January 28th, 2021.

Everywhere you look–Twitter, Instagram, your mom’s Facebook feed–EVERYONE is talking about GameStop. How a bunch of dumb kids on Reddit bought GME stock, “squeezed” some hedge funds, and the whole thing got “ruined” by Robinhood and the big bad suits “allegedly” colluding to screw the little guy.

Well folks, I’m here to tell you that just about every part of the story you’ve been told has been a straight lie, as I’ve come to learn from the last 10 months of total obsession over this incredible, soon to be world-shifting saga.

Why the heck have I, and hundreds of thousands of other investors whom are learning on the fly, put our lives on hold this entire year to laser-focus on every crumb of development around GME since this thing “ended” in January?

Simply, because the notion that this story “ended” in January is preposterous, a downright LIE, and the greatest example I have EVER seen of a blanket misinformation campaign to hide the truth from the masses.

The truth?

The GME squeeze never. actually. happened.

What did happen was a textbook can-kick by the institutions who were about to get poofed into oblivion, followed by a full year of bullshit propaganda from the media to convince YOU that the squeeze DID happen.

Unfortunately for these multi-billion dollar can-kickers, the only people that truly mattered to them–the GME investors around the world who bought and held the stock–did not budge. They only bought more.

And because of this…the fate of the Wall Street elite has been sealed: a far bigger short squeeze that won’t just blow their empire into teeny tiny pieces, but grant GME shareholders a war chest of life-changing, generational wealth.

“We have come dangerously close to the collapse of the entire system”

-Interactive Brokers founder and chairman Thomas Peterffy, February 17, 2021

This ain’t hyperbole, folks…what’s coming is about to change everything. A chaotic, out-of-control fireworks show the likes of which we’ve never seen in the history of finance.

Welcome to the greatest story ever told–I am humbled to be your guide.

BUCKLE UP.

REQUIRED HYPE VIDEO BEFORE PROCEEDING:

Below are a handful of core concepts and definitions that apply to the GameStop story, as well as a hefty dose of storytelling weaved in to help you understand the importance of each. If any of my explanations don’t click for you, I recommend opening up a separate tab and digging into the terminology yourself to make sure it’s internalized before moving on.

GME: The abbreviation for GameStop stock. Referred to as the “ticker symbol” in stock market lingo.

GameStop: The company at the heart of it all. They’ve been struggling in recent years due to straight-up bad management, showing ineptitude at transitioning the business away from its brick and mortar mall-retailer roots and into the digital age. Thanks to the new captain at the helm (Ryan Cohen) who has a STELLAR track record in the digitalization of outdated business models, the winds of change are in full swing at everyone’s favorite video game store.

Ryan Cohen: The new sheriff in town. RC came in like a wrecking ball as Chairman of the Board of Directors at GameStop, and the man means business. He’s a certified memelord, a silent-assassin, and has a KILLER background, headlined by Chewy, a pet food company he launched at 25 years old and grew into a $3.35 billion dollar stealer of Amazon’s lunch. He’s now a veteran e-commerce prodigy/billionaire at only 35 years old, and is primed to dominate the digital/tech/e-commerce space.

Keith Gill AKA The Roaring Kitty AKA u/DeepFuckingValue: The #1 boyfriend draft pick for wives everywhere. He reached legendary status by being one of the only people on Earth who saw this GameStop resurgence coming YEARS ago, and rather than hide that knowledge for himself, he decided to fight through the meat grinder of Reddit and YouTube naysayers to enlighten his fellow small investors of the enormous opportunity he saw.

His hundreds of hours of research created the foundation for this massive ball of knowledge, community, excitement, and inequality-destruction to get rolling.

In other words, an absolute lock for hall-of-fame status in the archives of financial history. Period.

Melvin Capital: The hedge fund that caught most of the media attention in Jan 2021 for overleveraging their bet against GameStop. As you’ll soon learn, though…they’re just a baby minnow in the fucksville sea.

In plain English, they are the judge, the jury, and the executioner at the same time.

I could write a novel of all the criminal allegations against Citadel, but to keep things short and sweet, here’s the baseline you should know in the context of our story:

As theorized by the sharpest minds of the interwebs, Citadel, led by their CEO Ken Griffin, swooped in to intercept Melvin’s short positions to prevent them from collapsing under the weight of GME back in January. Their reason for doing that? Likely to prevent a chain reaction that would have domino’d into the death of their empire as well.

Since then, there has been alllll kinds of debauchery going on with those toxic short positions that NOBODY wants to be left holding the bag on. It seems like every month the puck is being passed somewhere new so each SHF can report a clean book, and maintain the illusion that nobody is holding the hot potato.

This Reddit post breaks down the theory of Wall Street’s GME hot potato game in detail.

Ken Griffin: CEO of Citadel, and soon to be greatest wealth-inequality-breaking philanthropist in history.

SEC (Securities and Exchange Commission): The police of Wall Street–or at least they SHOULD be. For decades, they’ve been totally complicit to the rampant illegal activity going on in the financial markets. A few recent hires, Gary Gensler and Gurbir Grewal, gave the investor community some hope early on, but after several months of no action…it’s getting tough for the optimists to continue defending them. To their credit, they inherited an absolute MESS, so whether or not they’ll be able to turn things around and salvage a glimmer of trust for their image is yet to be seen.

Stonk: Just a funny meme-ified word for “stock” that was made up by degenerates of Reddit.

Apes: How GME investors refer to one another. This scene from Planet Of The Apes became a rallying cry in the early days, and remains a favorite mantra of the shareholder community today:

Retail Investors: Just another word for your Average Joe investors. Apes = retail investors that love GME.

MSM: Mainstream media. They are not your friend…especially when they are literally OWNED by the hedge funds who have their backs against the wall.

Diamond Hands: The term for holding onto a stock with the strength of King Kong no matter what craziness happens to the price.

Paper Hands: The opposite of diamond hands. If you get spooked by a dip, or tempted by a rip, and sell your shares, then you might want to buy your wife’s boyfriend an origami guidebook, because those hands are made of straight paper, my friend.

Example:

FUD (Fear, Uncertainty, Doubt): I actually dig Wikipedia’s definition for this one: “A propaganda tactic used to influence perception by disseminating negative and dubious or false information and a manifestation of the appeal to fear.”

Basically, misinformative garbage that’s spread across the internet to convince you that something is bad. Think “modern day agenda-fueled propaganda”

Robinhood: The most infamous of the stock brokers that “turned off the buy button” AKA shut down retail investors’ ability to buy GME during the January Sneeze.

Robinhood operates under a business model called payment for order flow (PFOF), which has been a HOT topic among governmental regulators this year.

Why is PFOF under massive scrutiny you ask?

Remember how I told you that Citadel has a hand in the actual flow of stock buys and purchases? Well, Citadel PAYS Robinhood a FRICK TON of money for those orders, so they can front-run them and shave teeny tiny profits off of every trade. It’s an extreme advantage, and has been under a great deal of scrutiny (as it should) by regulators since the events of January.

In addition to making a fortune stealing from retail investors on a per-trade basis, there’s been all kinds of evidence rolling down the pipeline that Robinhood shut off GME buys because hedge funds like Citadel and Melvin were massively short on the stock, so they strong-armed RH into nuking their brand to save their skin.

Aside from a few weeks of #KenGriffinLied (Ken Griffin = Citadel CEO) trending on Twitter, the true depth of this collusion hasn’t made it into the public eye yet. Methinks that once Citadel goes bye-bye, the lid will fly off the pressure cooker and EVERYONE will find out the extent they’ve been lied to all this time.

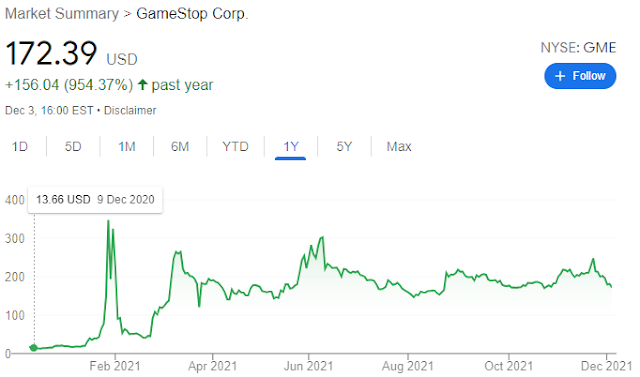

January Sneeze: The fake squeeze that occurred in late January 2021. MSM led the way on pumping the narrative that GME’s price run to ~$500 was “THE END OF THE SQUEEZE! That’s all, folks! Thanks for playing! Now everyone get back to your day jobs, nothing more to see here!”

It wasn’t until the weeks/months following that the apes of Reddit cracked the headlines wide open, digging deep into the plumbing of the market to prove without a shadow of a doubt that the squeeze never squoze–the mainstream narrative was a flat-out lie. This should be no surprise though, since as I mentioned earlier, all of these financial media outlets are under the thumb of the very same hedge funds that have their balls in a vice grip.

Let me say that one more time…

The “it’s over” narrative was fabricated, pure and simple, to scare the general public away from the real story, and ultimately to prevent more people from buying GME.

It was all an ILLUSION to pretend that the price tank from $500 to $38 was a result of retail selling. In fact, it was because the hedge funds threw 1, 2, 3 more kitchen sinks at the short button to slam it back down, thus digging their hole even deeper.

In that fateful moment in late January when the Sneeze was cut flat, what was already primed to be an explosive upward move became something MUCH bigger…

Ladies and gentlemen, this is when the MOASS was born.

MOASS: The Mother Of All Short Squeezes.

Look up “ENORMOUS, IMMOVABLE demand, and ZERO supply” in your Economics textbook.

Yup. The price should simply continue going up forever. Until apes sell, which, ya know, isn’t really a thing since they’re literally editing the HTML code on their browsers to remove the SELL button.

This bizarre, parabolic explosion a la MOASS isn’t just possible for GME, it’s all but mathematically guaranteed given the circumstances, barring some sort of illegal witchcraft fuckery unlike the world has never seen. (We’ll dive further into this skeptic concern later, in the Arguments Against section. Quick-take: I ain’t stressin’ on it.)

In other words, what happens when the spoiled children of Wall Street can’t take an L, so they dig themselves a World War I trench-sized hole so deep that it threatens the integrity of the entire global economy?

DD: Due Diligence, AKA what people on Reddit call their in-depth research posts. This is where the Short Hedge Funds truly fucked up–they inspired MILLIONS of lowkey brilliant internet dwellers to work together and solve the labyrinth of mystery that old-money has constructed to confuse the masses into ignorance and hopelessness in the markets.

HF: Hedge fund. Think gigantic club of rich old people that have no intention or ability to provide actual value to the world, so they spend all their time running around Wall Street finding innovative ways to leech off of those that do.

SHF: Short Hedge Fund, AKA the “big money” formerly known as “smart money” who bet against GameStop (shorted it), and therefore Ryan Cohen, DFV, and the millions of apes who are literally too dumb to find the sell button on their computer screen.

Going “long” on a stock: The traditional form of investing. You buy a stock low, hoping that it will go up, so you can sell it for a profit.

Going “short” on a stock: Betting AGAINST a stock. Unlike the traditional idea of investing, where you buy a stock hoping it rises in price, when you SHORT a stock, you actually SELL first, and BUY later. Thus you want it to go DOWN (ideally zero–the company going bankrupt) so you can buy the shares back at the lowest price possible, and pocket the difference between the original sell and the subsequent buy.

Shorting a stock is VERY RISKY, because it carries infinite risk.

When you buy a stock first (going long), your maximum loss potential is that stock going to zero. But when you SELL a stock first and must buy later, that stock can theoretically keep going up and up and up, growing your bill infinitely.

Oh and another thing…when you’re forced to bite the bullet and buy these shares back that you’ve short-sold (called “closing your short”) the buying pressure from these forced share purchases rockets the stock even higher. It creates a sort of “infinite feedback loop”, with the potential of going positively stratospheric if apes hold onto their shares with 💎🙌–since the shorts need to buy the shares that apes hold.

This is the nightmare scenario for every institution that’s shorted to hell on GameStop, because there’s nothing…NOTHING they can do once this self-feeding shitshow starts rolling for real. Last time it started veering off the rails, the Robinhood fiasco happened, which essentially destroyed their brand over the course of a single day. NO brokerage wants to face that same demise.

Naked Shorting: You may have heard back in Jan. how GME was shorted over 100% of the float (226% according to Robinhood’s legal filings, which we’ll be looking at later).

How can they short more shares of GME than even exist?

But also, because the SHFs were SO confident and SO greedy in their belief that GameStop would crumble to dust under their vicious shorting attack. They didn’t think in their wildest dreams there’d ever come a day that the investing public would catch onto their scheme, and use it to screw them right back in the bunghole.

Float: The shares of a company which have been issued to the public for trading on the stock market.

As in, if apes buy up all the shares of the float, they will have complete control over how high the price goes in an all-out MOASS scenario.

And by the way, it’s actually possible for the apes to buy MORE shares than exist in the public float, since SHFs have pooped out boatloads of “synthetic shares” in order to keep the shorting train rolling.

The result of this is, once the chickens come home to roost, the SHFs will have to buy the entire float-worth of shares back from apes multiple times in order to close their positions.

Short Interest (SI%): A general measure for the percentage of the FLOAT that has been SHORTED by SHFs. This shouldn’t ever go over 100%, since that would imply that naked shorting has taken place (AKA shorting shares that they don’t have), but due to a laundry list of loopholes being used to hide GME’s true SI%, there is a very real (yet speculative) possibility that it could be in the THOUSANDS of percent.

Just a couple of the data-backed theories that we are in complete stupid-land as far as SI% (note that these are now OLD posts, meaning that after several more months of continued ape buying + short suppression, these are lowball estimates 🥴🥴🥴:

To give you an idea of how utterly insane these 3,000-10,000 P-E-R-C-E-N-T short interest estimates are, remember that back in 2019-2020, Tesla stock was considered very heavily shorted at 20%, as in TWO ZERO percent.

What happened next? A 10,000% gain (100x the starting price) TSLA short squeeze.

***Side note: It’s probably a good time to emphasize that basically all exact numerical data, SI% being a glaring one, is NOT ACCESSIBLE to the public. This is one of the main projects of the smarter apes in the GME community–analyzing every single piece of data that we do have to infer as accurately as possible. If we ever DO find out the true numbers, we’ll probably be reading them from our moon journal, with the deep abyss of the starry night outside our window.***

Closing/covering shorts: (These are different things, but so many people mistakenly use them interchangeably that I’m not going to get too deep in the weeds on semantics. This article does the best job I’ve seen clarifying the difference if you wanna git learned).

The shorts’ act of buying back that stock that they sold first, and returning it to whom they borrowed it from.

Guess what–when shorts are forced buy that stock, it causes the price to fly up EVEN MORE, forcing other shorts to close their positions, creating an inferno of very sad hedge fund managers and very happy primates.

This self-feeding shitshow extravaganza is commonly referred to as a…

Short Squeeze: The official term for the situation above, where those “shorting” a stock get stuck in a continuous loop of closing their positions, blowing up price, needing to close more, etc.

Their losses in this case COULD push infinity, since there is no inherent ceiling to how high stocks can go. How could this infinite scenario happen during a short squeeze? Glad you asked…

Margin Call AKA “Marge”: Again, super over-simplified here, but the jist of a margin call (technically a failed margin call) is this:

When HFs get too deep into poo poo land, the financial institution(s) above them in the pecking order (example: Bank Of America, the “daddy” of Citadel the SHF) can pull the rug out from under them, completely blowing up whatever manipulation fuckery they were using to prevent the short squeeze from rocking their shit.

Using this example, why would Bank of America want to screw Citadel like this? Because Citadel is paying loads of money on interest to keep the GME price down, and if their attempts to get apes to sell keep resulting in fat L’s (💎🙌) then BofA is the next in line to foot the bill when Citadel hits the *GAME OVER* screen.

And trust me…nobody wants to pick up the GameStonk tab.

Something to note however: it’s possible that these institutions above the SHFs are so intertwined in the corruption that it may be more complicated than “margin call Citadel = home free.”

The resulting market disruption if they were to rug-pull Citadel would be so big that it could bite them in the ass in all kinds of fun and exciting ways, since they have a ton of long positions in the market as well, which would get killed in a mass-liquidation event.

In normal times, Wall Street is nothing but a bunch of bloodthirsty sharks, all trying to eat each other at any opportunity. But this time, the very way that they ALL make their money (spiking the SEC’s Capri-Sun stash with Ambien while robbing retail blind, mainly) is at risk of falling apart for ALL of them. It all depended on keeping the convoluted labyrinth of secrecy intact, and well…now this is happening:

We already saw Citadel run to Melvin’s rescue in January, which some wrinkle-brained apes have theorized was a textbook example of this desperation-induced-teamwork (AKA GME hot potato as referenced to earlier) taking place I.E. it’s possible that we don’t see a prototypical margin call process happen, but rather a much more convoluted shitshow of institutions going KA-BOOM left and right with no rhyme or reason.

Prime Broker: The technical term for those big bad bois above the hedge funds, AKA Bank Of America in the example above.

There are even bigger whales out there, but they’re a bit outside the scope of this post.

Infinity Pool: Originally coined by Redditor u/BluPrince (screenshot below), this endgame theory is basically an extra spin on the margin call scenarios we outlined above. It states that if each ape placed a portion of their shares into an aggregate “never sell pool”, and that pool grew big enough to cover the entire free float of shares (meaning it would be impossible for SHFs to buy any of these shares to close out their positions)…

F***, guys.

Do I even need to keep repeating myself?

This shit is purely, positively bonkers in a way that cannot be logically explained. The possibilities are flat out ridiculous!

The full Infinity Pool DD post can be f

ound here.

This is the point where I begin to tell my family, friends, and colleagues…why would you not take a shot at this? I mean really…I know I’m an idiot non-financial advisor, but I can tell you that after 10 months of following this thing with coffee in hand and crazy-eyes bouncing from Reddit post to Twitter thread to Reddit post…there has never been an instance in the history of the stock market where a single security has been SO shorted, SO misunderstood, and SO firmly held by SO many shareholders at the same time. It’s a recipe for complete madness, it WILL end in fireworks, we just don’t know exactly how, or when. Financially, historically, socially–it’s flat-out unprecedented in every way–a burning fuse that once lit, will lead to an explosive transfer of wealth from the largest funds on Earth to the brokerage accounts of normal, everyday people.

If you’re new to this story, I hope you’re beginning to understand why this situation fascinates millions of investors to no end. The amount of co-mingling pieces strewn across the chessboard can make it appear complicated, but what it really boils down to is this:

Total chaos is on the horizon, and every sign is pointing straight toward the moon for those able to see through the dumpster fire that is mainstream media.

This will be the kind of event that’s written about in history textbooks for generations…and you’re telling me that all anyone has to do to participate is to buy and hold a stock that’s already undervalued as it is??

We’re now going to take our time machine back to the events surrounding the January Sneeze, and review the story the mainstream media wanted you to believe. This will be a very short section, because, well, the story the mainstream media told was exactly that–short.

TLDR:

“Well that whole GameStop thing was cool, huh? Bunch of normal people gave Wall St. a nice scare! Very inspirational! Bummer it didn’t work out because, ya know, mean ol Robinhood and the big bad guys were up to their tricks again. DARN. Anyways, go ahead and get back to your day jobs while we collect checks from our advertisers, no need to do any further research on this GameStop thing, it is oooover! Haha. Heheheh. **starts sweating**”

-Literally every MSM station, news conglomerate, and online newspaper

Think about this. Why would news-reporting companies be paying money to tell people that the chaos was over? Specifically when that very same chaos undoubtedly made their advertisers salivate since the whole damn world was tuning in to watch it unfold.

It suuuuuuure seems like someone(s) with a bigger wallet stepped in with a very clear message they wanted on the airwaves.

Let’s all remember who’s really running the show here…

Hm. Interesting.

Almost seems like literally every member of the ruling class wants YOU to put GameStop in the rearview mirror.

I actually followed the push notifications for a few of these “news” apps on my phone back in the early months of 2021, and can confirm firsthand: whenever the GME price dipped down, my phone damn near finished me off through my pants with notification buzzers, articles, hit pieces, flashing red stock photos, the works.

When the price went up?

*Crickets*

Little psychological tactics like these were everywhere. From the media articles, to Google removing negative Robinhood reviews following their nuking of the buy button, to the thousands of obvious bot accounts deployed across Twitter and Reddit to spread FUD…it was impossible to avoid the noise.

Operation Infiltration

In addition to MSM’s inundation of hit pieces flooding boomer brains everywhere, there was also a massive bot campaign deployed across Twitter, Reddit, and even Facebook groups under GME-related keywords.

The goal? To craft a hybrid-narrative that the squeeze was over, everyone URGENTLY needed to go buy other stocks instead, and everyone still holding GME was not just bagholding, but somehow hurting other people’s feelings in doing so (LOL).

This was one of the most glorious examples of Wall Street believing that simply shoveling money into fake accounts and social media algorithms would be an effective strategy. To the contrary, these desperation heaves were snuffed out immediately every time by the citizens of Reddit, once again reminding every ape just how valuable their GME holding must be.

These hail marys were one of the primary inflection points that separated the casual observer plebs with the hardcore GME chads.

The majority of the public ate MSM’s shit sandwich right up, and went back to their usual lives. But a very special group of people–the type that literally eat crayons for internet points–were simply too dumb to follow MSM’s instructions, and decided to go on a little intellectual adventure of their own.

With each new round of FUD they witnessed, these degenerate apes became even MORE convicted, and dug deeper and deeper into the inner workings of the market to find out what was really going on.

If my glorious Glossaramble didn’t make it clear, the Redditors’ consensus on MSM’s GME narrative can be summarized in one word: BULLLLLLLLLLLSHEIT.

Let’s start with a bit of devil’s advocate:

“The GME price went up so much! That HAD to have been “it”, right? Was MSM correct in calling that the ‘GME squeeze’ thousands of times in print?”

ANSWER: Absolutely not.

Conventionally, short squeezes cause big runs up in price, which was enough precedent for the normies to take MSM’s word for it, and assume it was done.

But after digging through the surface layer of math and simple market mechanics, the “January squeeze” narrative goes bunk immediately.

I want to avoid making this a data-heavy post, but just to be clear, the SEC’s own report (yes they’ve been useless in regulation, but they have access to the best data out there) confirmed that what we saw in January was NOT the squeeze:

The jist of this data set, piggybacking off of our analogy from our necklace example from Section 3: All of those necklace-borrowers who owed their friend their necklace back were NOT buying them from the pawn shop (orange bars)…to the contrary, all of the other similar necklaces available around the world (which they desperately needed to repay their friend) were being snatched up left and right by a bunch of external necklace lovers on the internet (blue bars), making it even more difficult for the original necklace-borrowers to get enough necklaces to repay their friend back.

…in other words, the SHFs never made their repayment. They simply tripled, quadrupled, and quintupled down by pooping out a bazillion more synthetic shares (borrowed even more necklaces) which CAUSED the fake GME dump down to $38 in Jan.

This created the illusion that the short squeeze had run its course, but as the data clearly shows, it never even started. Of course MSM ran the story that it was all over and retail sold, and since most people haven’t followed the data obsessively for all of 2021, they believed what their talking box told them.

OH and I should probably mention, for the last 10 months, the SHFs have continued creating more and more of these fake shares to keep the GME stock price suppressed, meaning literally every day that goes by, the spring is coiled tighter and tighter (since the more synthetics they create, the more shares apes can buy for their money, further building upon the Mt. Everest of shorted shares they must buy back from those same apes at whatever damn price they choose).

Want to see what apes gobbling every synthetically-printed share looks like? Below is a representation of buy vs. sell orders on Fidelity (the #1 retail broker) for the entire month of July:

As you can see, despite the overwhelming majority of orders being BUYS, the price of GME still went down. This indicates that SHFs are partaking in HEAVY, ONGOING SHORTING to counteract those buys in order to suppress the price. As long as this continues, the stack of floats that the apes hoist into the infinity pool will continue to grow, since they’re buying up every dang synthetic that’s being printed through this perpetual dipping machine Kenny & Co. have running in their back office.

Let’s check another data source. Below is a Bloomberg Terminal. It’s widely regarded by the professional investment community as the most accurate, reliable source of market data there is. (One of these bad boys costs a cool ~$25K/year to use, so yeah, it’d better be dang good.)

Captured in the thick of the January Sneeze, right up there at the top we have GME, coming in at 141.71% short interest.

BUT WAIT, THERE’S MORE!

Robinhood faced a flurry of lawsuits after removing the buy button in January, and in one of the biggest ones, they were forced to state the SI% at the moment they cut the cord on the free market:

So here we have 2 of the most believable sources we have proving GME SI was well over 100% at peak Sneeze, which doesn’t even begin to account for the following 10 months (and counting) of continued hole-digging thanks to the SEC’s busy schedule of sleep, naps, and slumber.

How many hundreds (or thousands) of percent short is GME sold at this point? Nobody on earth knows; I doubt even the SHFs have a clue anymore. Their entire life has been reduced to smashing every short button they can find just to live another day.

While we’re having fun here, let’s toss in a thorough review and conclusion straight from the

SEC’s official “GameStop Report” that “a short squeeze did not appear to be the main driver of events”, heck it was “not [even] consistent with a gamma squeeze” (AKA a much smaller type of squeeze resulting from options volatility, NOT a short-closing bonanza as described earlier).

Even the most hardcore bullish apes assumed a gamma squeeze had played at least some part in the Sneeze run-up, but according to the SEC, we didn’t even see the preview of the preview of GME’s unraveling.

This settles ALL doubt. We didn’t see a damn thing in January.

SHORTS AIN’T CLOSED SHIT. PERIOD.

All of this confirms that the run-up and dump of GME in late January was a can-kick to end all can-kicks. These hedge funds were about to get caught up in the biggest short squeeze in history, so of course they took advantage of the complete lack of regulation, and found a way to ensure the squeeze became even BIGGER later…to the point where it sucks the entire global economy into the picture.

The SHFs’ plan following this suicide play was simple: use their network of propaganda-spreaders, er, “financial media” to tell everyone that this dump in price was a result of everyone selling their stock and going home. Hell, we’ve seen entire documentaries and books published and distributed to pump the narrative of “that’s all, folks! Time to go back to your day jobs!”

But even with ALL of this…the power of gamers had not been accounted for…